Take control of your monthly bills and pay the amount that you need to pay, so that each month it is the same. Sound crazy? PG&E will let you pay an average of your bill if you set it up with them. They switch the amount on occasion, which can mean your bill goes up when you don’t expect it to, and then it’s changed to a smaller amount, which you know will put you behind. I found their system very frustrating, not the simplifying of my life that I hoped it would. So I started averaging my bills my own way.

Your gas bill comes in and because it’s wintertime it’s $30 more than last month. Or maybe your electric bill is down by $40 in November because you are no longer using your air conditioner. If only your bill was the same each month. It’s easy to do this. It is best, but not necessary, to start it at the time of the year when your bill is low, to help keep it even. It’s possible to start at any time, just keep in mind that you cannot start out paying less than you owe, so your first few months may have to be at the actual amount due or higher until you reach a month under your average bill amount.

Averaging your bills

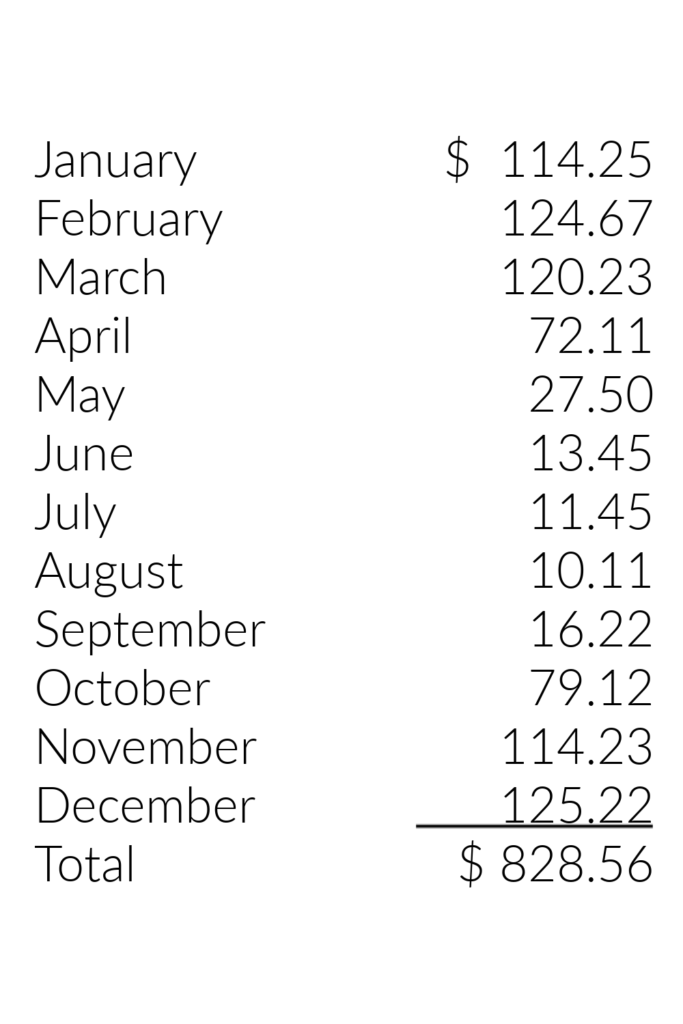

Let’s say this is the list of your gas bills for 2019, on the right. That’s a big difference from the lowest to the highest bill. To calculate what you would pay for each month, take the total of $828.56, and divide it by 12 months. That will give you $69.05 a month. Because there are always increases in rates and fluctuations in temperatures, I would round that up to $75.00. That would mean that you would pay $75 a month starting in April. Up until then pay your regular bill. This will result in overpaying April – September. In October, November, and December there should be enough to cover your bill. There will also be enough to cover January – March, as long as there wasn’t a long heat wave or cold spell to mess you up.

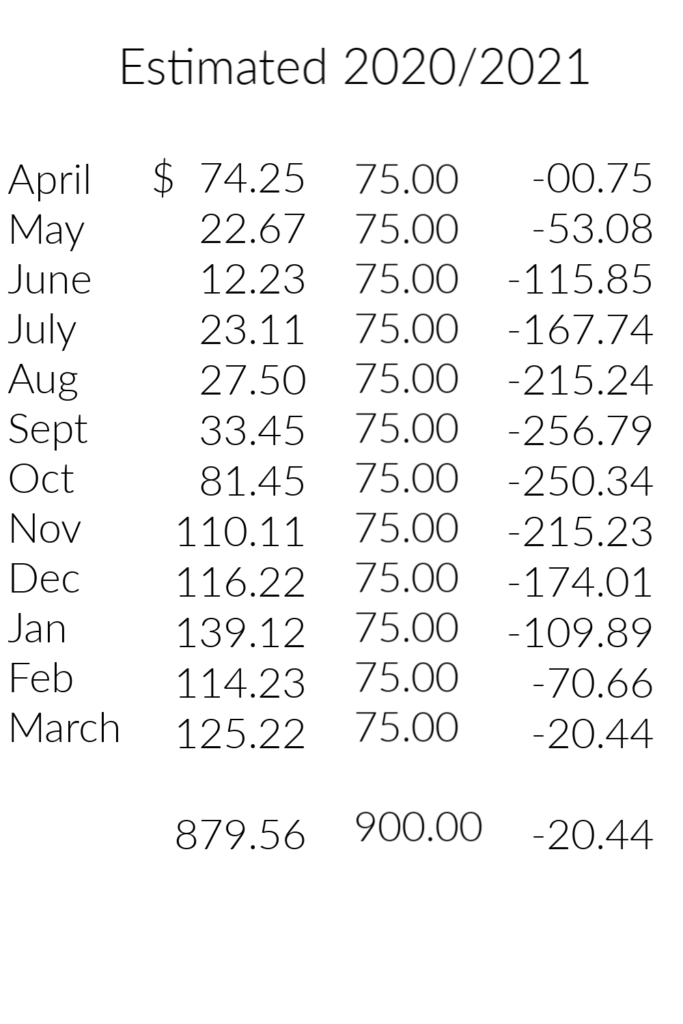

Here, on the left, is an example of an increase in the bill used above by about 6%. The first column represents your payments due. The second column shows your averaged payment that we figured out above. The final column shows what you have overpaid. As this continues each month, you will see that your overpayment increases until October, when your bill gets higher. In the end, you will have a negative balance of $20.44, in other words, you are overpaid by $20.44. This is less than $1.75 a month extra. Each month you knew what was owed. There weren’t any surprises. When we get the -$200 a month bills at my house, my husband doesn’t understand why I do that. Each month I explain that once winter hits I’ll still be paying my averaged bill amount, not hundreds of dollars.

Other options

This is ideally how it will work. Keep in mind that an unusually cold winter or extremely hot summer could require a payment change. You have the responsibility to make sure your payment covers your bill. If it would make you feel better, you could average out the last three or more years to get a more accurate estimate. Remember, this is an estimate. And bills tend to get higher every year, so you might need to add a bit extra to that amount.

If it bothers you too much to hand over your money early to the gas or electric company, you can put aside $75 a month in a separate service charge free account. Then transfer the amount you actually need to your checking account once you receive your bill. It can be a bit more work, than the method I have described above.

Breaking down your expenses

You should maintain a list of bill payments that are due each month. This list of bill payments must, of course, be covered by the income you receive each month. If you don’t have a budget, now would be a good time to make one. The simple way to do this is to determine what you make each month. This amount should be the net of our paycheck after all taxes and insurance are taken out. Then make a list of all your bills. This can take time and it’s always possible you forget about something until after you have been doing this a few months. Bills that are easily forgotten include insurance, property taxes, gift expense, medical deductible expenses.

Listen to Dave Ramsey

Dave Ramsey recommends the following percentages for your expenses. You may find yourself over or under these percentages. And some of these expenses may not apply to you. This is a recommendation and I agree with his figures and his plan to reign in your bills and become debt-free. That does take time, but you can do it if you put your mind to it.

- Housing 25-35%

- Utilities 5-10%

- Food 10-15%

- Transportation 10-15%

- Health 5-10%

- Insurance 10-25%

- Savings (Regular and Retirement) 10-15%

- Giving (Charity) 10-15%

- Personal 10-15%

- Recreation 5-10%

There is flexibility in Dave Ramsey’s breakdown. Realize that you can’t go high on every section, without putting you way over your budget. You may, for now, have to reduce your savings, personal expenses, and recreation, as you adjust your expenses to your income.

Bill payment sheet

Some bills are the same amount every month. They do of course go up once in a while. The bills that are predominantly the same each month include Internet, Cable, Satelite TV, rent, health insurance, car insurance, renters insurance, or homeowners insurance. There is no incentive to pay them ahead unless they give you a price discount for paying six months or more at a time. My insurance will charge me $7 a month to pay monthly. If I pay my entire bill for the year, I will save $84 a year. I realize that isn’t possible for everyone, but if you have the money, it might be worth the money savings.

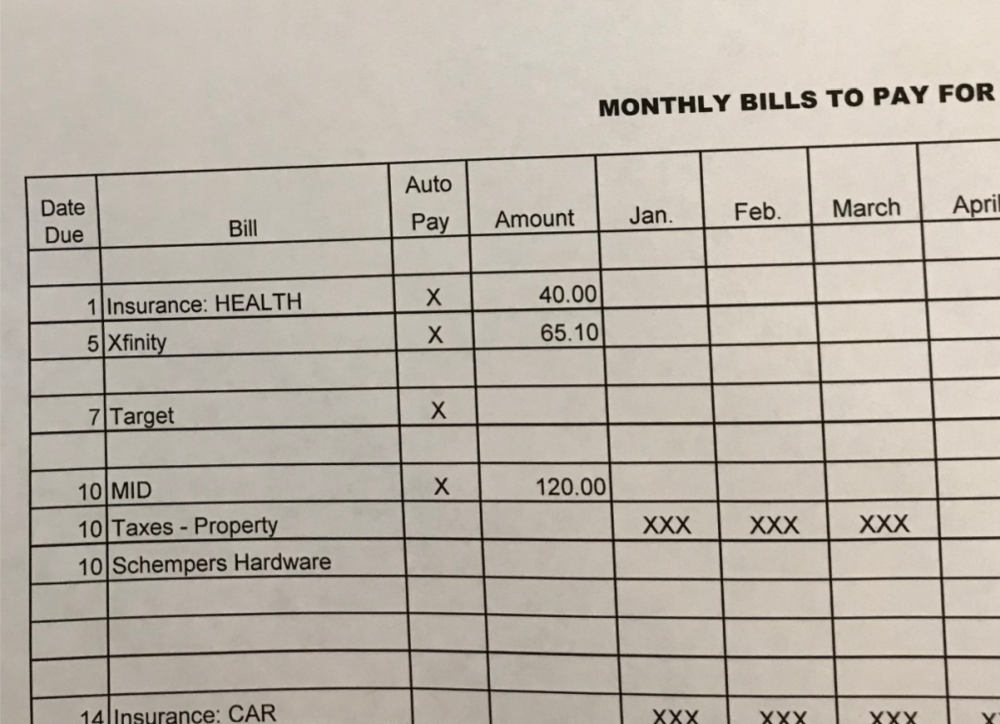

This is a sample of my bill payment sheet that I use for the year. I have made a new one for you to print out and use, below. (Note: I have switched the order of the columns and added a notes section in the new one.) I put 3 X’s in a month when that bill is not due – like the Taxes-Property in the example.

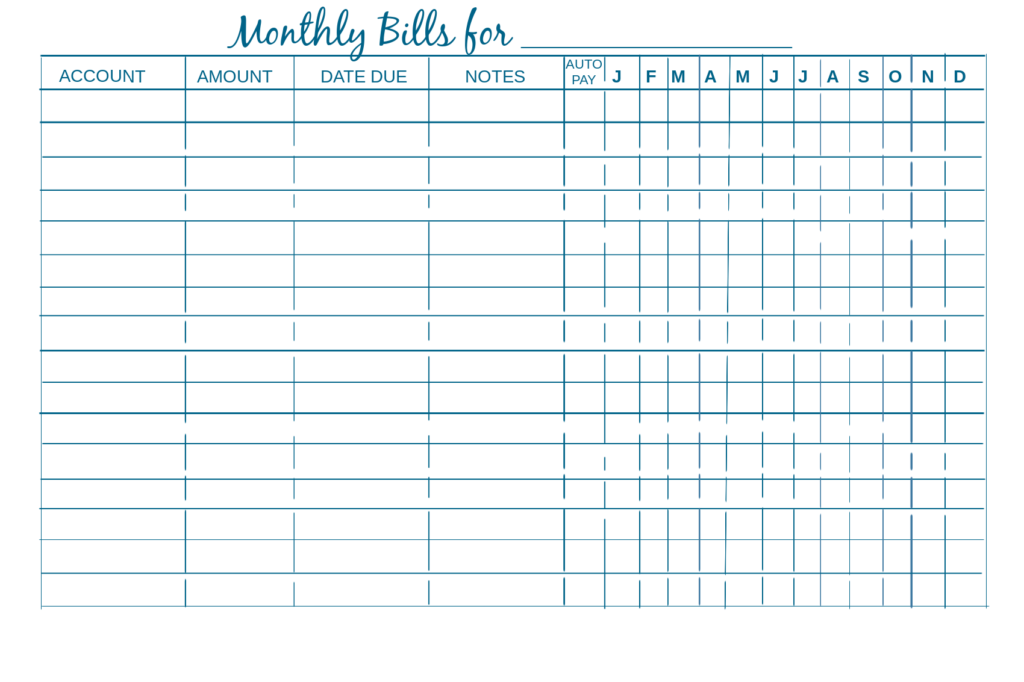

Looking at the new form below, “Account” would be who is being paid. The “amount” is entered if the amount is the same each month. I usually pencil it in, since this amount can change. If the amount changes every month, as a credit card would, I leave it blank. The “Date Due” is the date the payee must receive payment, so be sure to arrange for payment or mail your payment in plenty of time. Under the “Auto Pay” column, I put an X if the money is automatically pulled from my checking account by either the bank or the payee. (See above) The “Notes” column is to write a note if needed. If I have paid my car insurance for the year, I will note something like “Pd. Thru 7/18/21.” I put a checkmark in the month for each bill I have paid. If there is no mark I need to find out if I missed marking it or I missed paying it.

I have made a new one that I have attached for your use. Please click on this link:

https://growingoldereveryday.com/wp-content/uploads/2020/10/Untitled-8.png

Pay off your home quicker

Since we are talking about paying bills, if you are able to, you should pay a little extra on your home loan each month. This will help pay it down quicker. Let’s say your house payment is $1,000, try to pay $1025. Another way to pay your home loan down quicker is to make payments every two weeks, for half your payment. To accomplish this you will be paying your first half-payment, two weeks early. Example: $1,000 is due on the first, pay that. Two weeks later pay $500 and keep going that way. In the end, you will have paid $500 x 26 weeks or $13,000 a year, instead of $12,000.

Take Control

Take control of your expenses. Reduce any you can. Pay off your home quicker. Set up your budget. Use Dave Ramsey’s guidelines to see in which areas you may be spending too much money. If you need more money to pay your bills than you make, either reduce or eliminate some bills or take on a side job. Do your best to pay off your credit cards each month, or eliminate them completely. See this post about eliminating some of your credit cards: https://growingoldereveryday.com/should-you-be-eliminating-credit-cards/

It is important to stay on top of your bills. If you get behind you need to contact the payee and make a repayment plan. Do not wait for them to contact you. You may need to cut your expenses if this happens or increase your income. Do not use a cash advance from a credit card, unless you have looked into every other possibility.

I hope you are successful in taking control of your bills. Do you have any other ideas that have helped you? Please comment below. I love hearing from my readers.